rsu tax rate uk

Many people will have none many will have one and some may rack up more than a. Where the average weekly earnings were less than 30000 previously 15000 the rate of JB payable is.

Rsu Taxes Explained 4 Tax Saving Strategies For 2021

High-growth companies tell us that finding and retaining top talent when a business is scaling is one of their key risk areas and balancing the needs of founders investors and.

. Each PBS RSU represented one share of Carnival Corporation common stock. The reporting person was eligible to earn from 0-200 of the target amount of PBS RSUs to the extent that Carnival Corporation plcs annual operating income as adjusted for certain fuel price changes and currency exchange rate impact for each of the three fiscal years in the 2019-2021. Income tax expense in the first quarter of 2022 was favorably impacted by excess tax benefit related to the vesting of share based compensation decreasing the effective tax rate for the quarter by 17.

Irrespective of internal and external factors the ultimate goal of the CEO MD is to achieve a business objective and running operations of the company smoothly. The rate payable depends on the claimants average earnings in the governing contribution year. Account balances are credited at a rate equal to the highest rate offered on the Bank certificates of deposit as of December 31st of each plan year.

CEO MD is expected to maintain integrity as a CEO is no less than a representative of the firm to the. Tropico C Subscriber Line Digital Concentrator. Our expert team can advise whether a non-tax advantaged share option or RSU arrangement is right for you and support you through the implementation process.

Tekelec 9000 Distributed Switching Solution formerly SanteraOne Tekelec 7000 Class 5 Packet Switch formerly Taqua Open Compact Exchange Tropico. Common goals of Chief Executive Officer vs Managing Director. 3 TO PROSPECTUS DATED AUGUST 2.

Marriages are not distributed uniformly. Income Statement Formats are the Pro-forma for the presentation of an income statement which shows the result of the organization for the period ie. Profit or loss and it differs from country to country as every country has different rules and according to which every country present the income statement of the entity as per norms and.

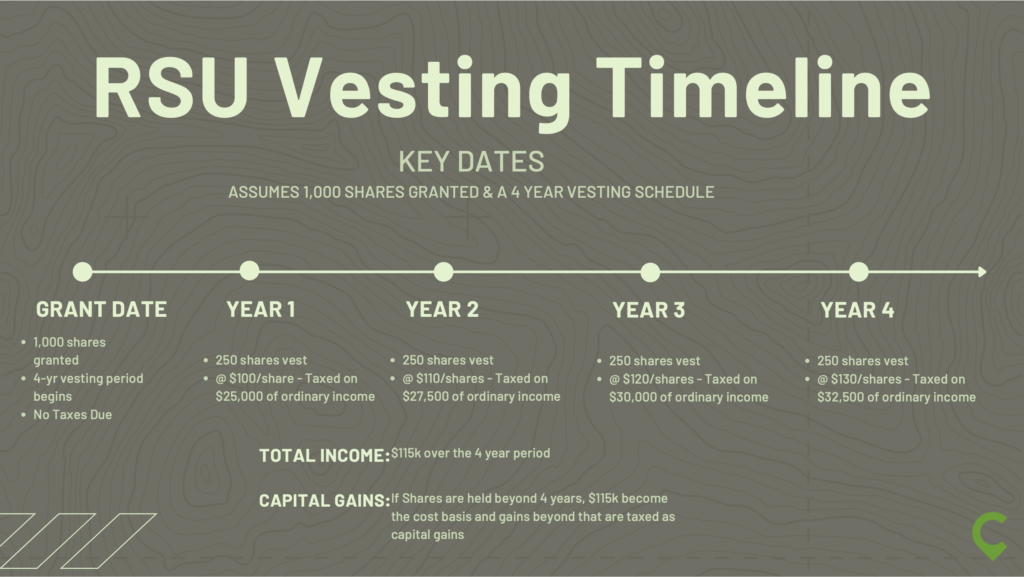

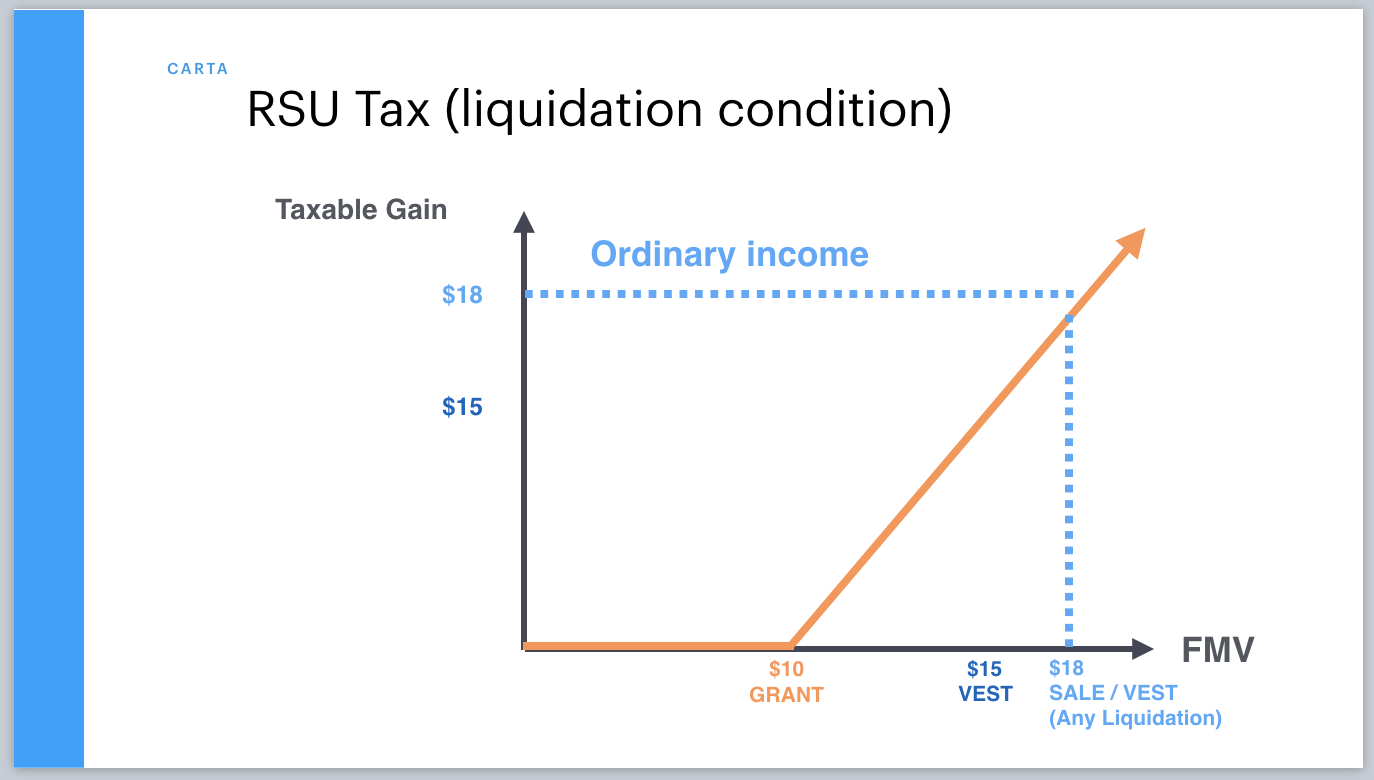

Schedule 1 Line 8z. In all cases there is no tax to pay when RSUs. The exact tax treatment will depend on your individual financial circumstances how your employer has set up the RSUs and the vesting schedule.

Definition of Income Statement Formats. For employees tax withholding occurs at NQSO exercise or restricted stockRSU vesting and the income should appear on Form W-2. Work with outsourced providers ensuring all non-UK payroll tax filings and payments completed Arrange payment of wages where applicable taxes and social securities via Citibank JP Morgan websites liaising with the Treasury team for funding Prepare base pay reconciliations for all payrolls under your responsibility in a timely manner Be responsible for the reconciliation of.

IRS Form 1099-NEC for nonemployees. There are just too many variables to create a one-size-fits-all RSU tax calculator for UK employees. From the 1st January 2009 where the average weekly earnings in that year are 30000 previously 15000 per week or more the full personal rate of JB is payable.

Having a divorce rate of 60 does not mean that 60 of married couples are unhappy even though the divorce rate is not 60 as your link 2 shows -- the peak divorce rate is for marriages originating in the 1970s of which 48 did not last 25 years. 333-257190 BLUE OWL CAPITAL INC. If youre looking for an RSU tax calculator for the UK Im afraid that there isnt one.

UK 101 UK 102 PBXes up to 23 and 57 lines UK 111 UK 112 PBXes of higher capacities expandable to thousands of lines Tekelec. Table of Contents Filed Pursuant to Rule 424b3 Registration No. The first quarter 2022 effective income tax rate was 223 compared to 225 in the first quarter of 2021.

Running a firm successfully.

What Are Restricted Stock Units Rsus And How Do They Work Plancorp

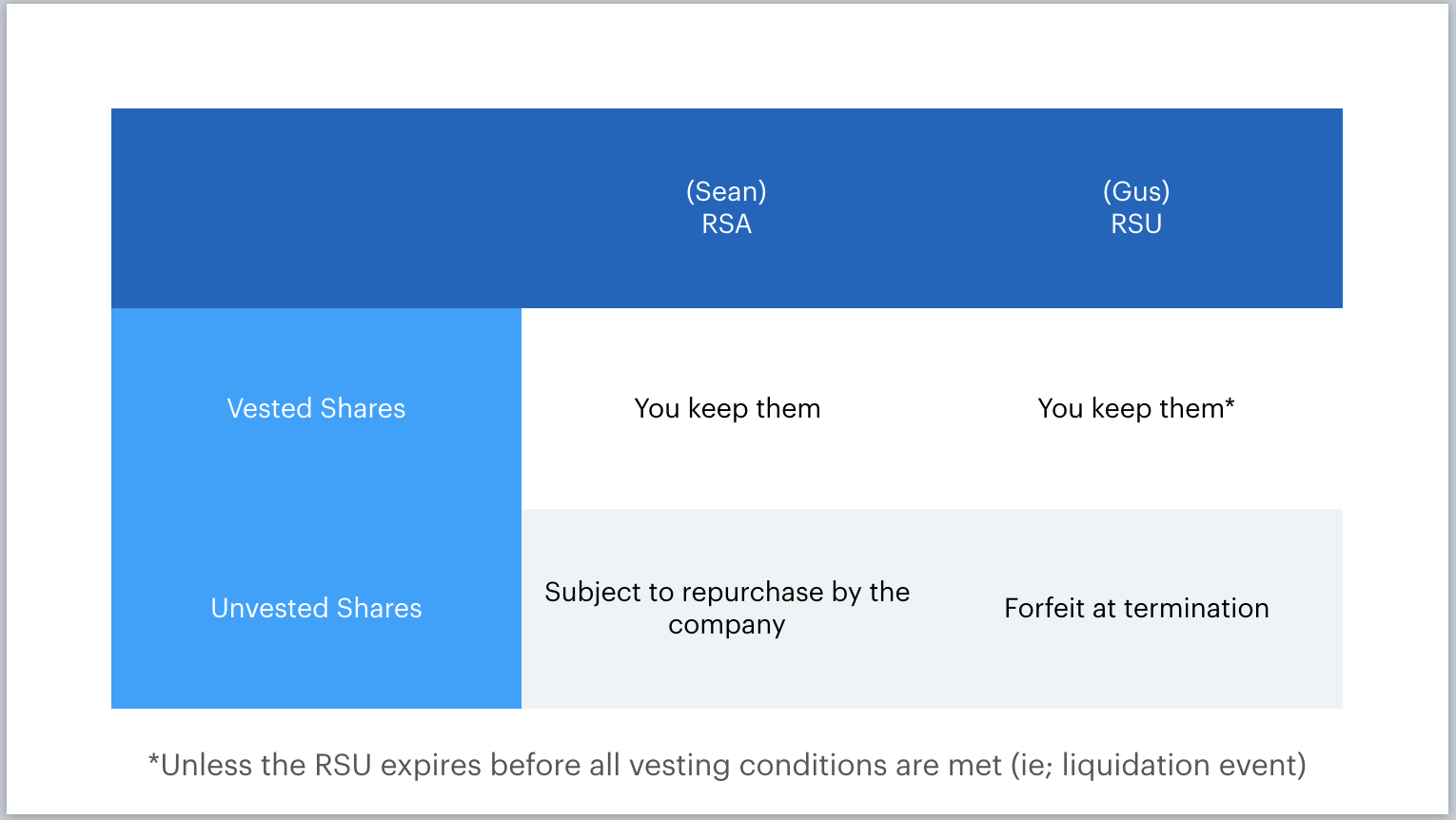

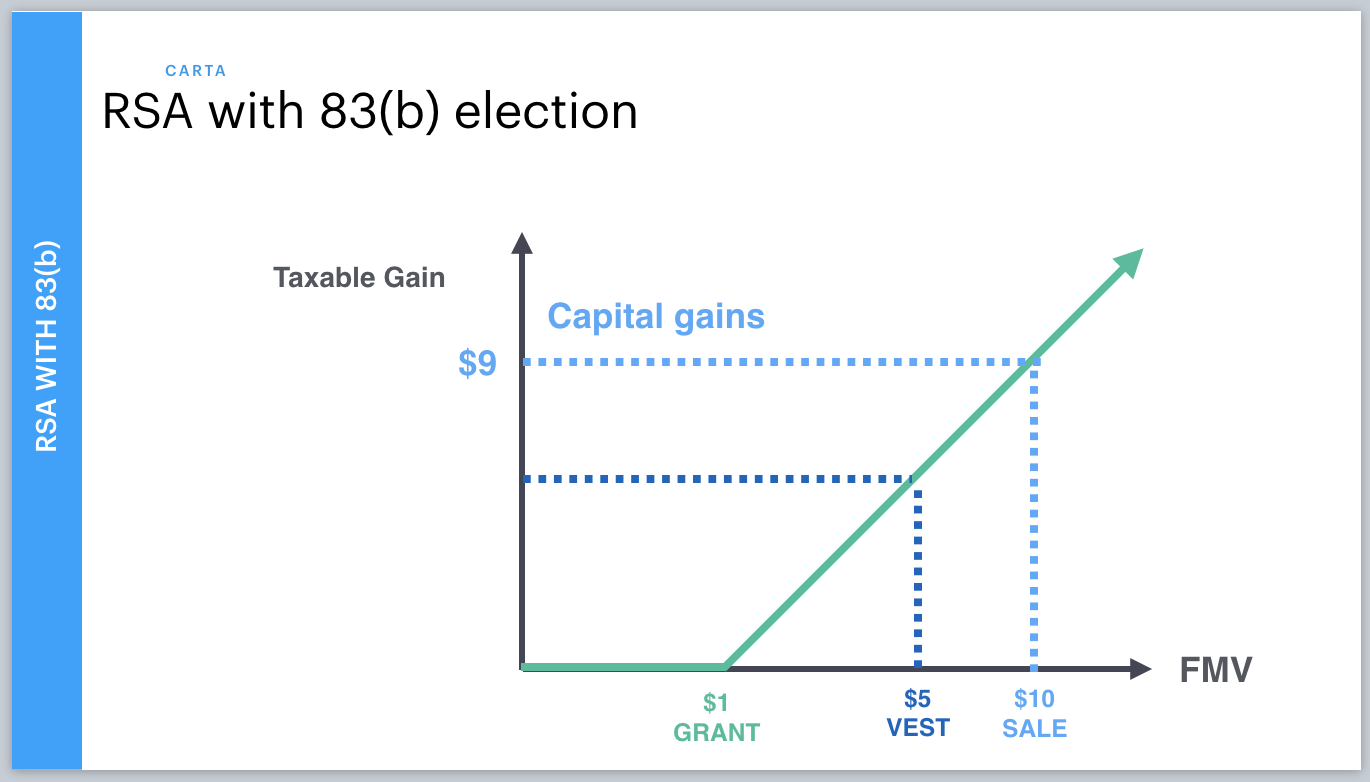

Restricted Stock Awards Rsas Vs Restricted Stock Units Rsus Carta

A Tech Employee S Guide To Rsus Cordant Wealth Partners

What Is A Restricted Stock Unit Rsu Everything You Should Know Carta

Restricted Stock Unit Rsu Tax Calculator Equity Ftw

Restricted Stock Unit Rsu Tax Calculator Equity Ftw

Rsu Taxes Explained 4 Tax Saving Strategies For 2021

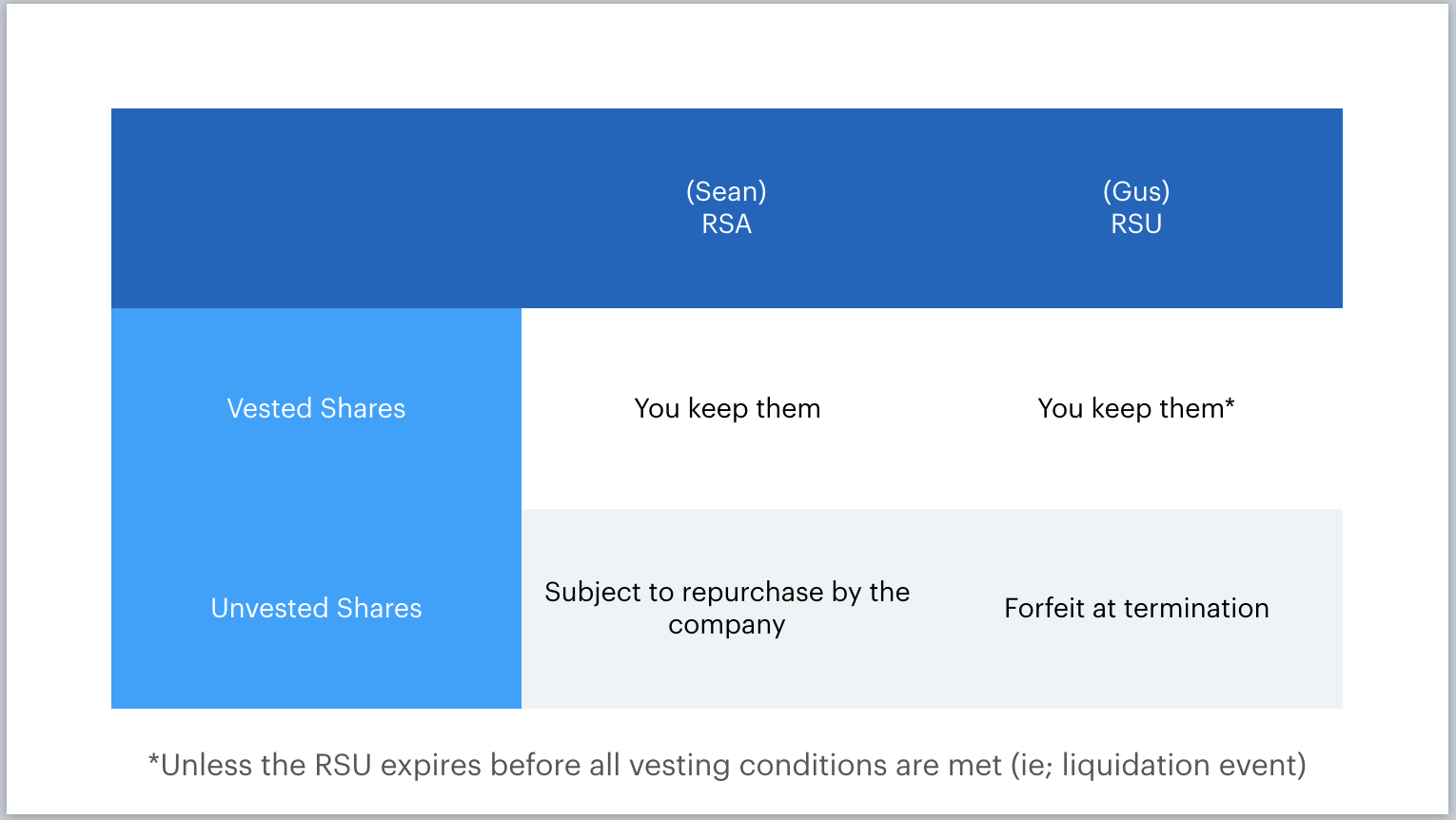

Restricted Stock Awards Rsas Vs Restricted Stock Units Rsus Carta

Restricted Stock Awards Rsas Vs Restricted Stock Units Rsus Carta

Restricted Stock Awards Rsas Vs Restricted Stock Units Rsus Carta

Rsu Tax Rate Is Exactly The Same As Your Paycheck

Restricted Stock Awards Rsas Vs Restricted Stock Units Rsus Carta

Rsu Taxes Explained 4 Tax Saving Strategies For 2021

Rsu Taxes Explained 4 Tax Saving Strategies For 2021

Restricted Stock Unit Rsu Tax Calculator Equity Ftw

A Tech Employee S Guide To Rsus Cordant Wealth Partners

Are Rsus Taxed Twice Original Post Link By Charlie Evans Medium